Imagine attending a concert where the crowd’s cheers ripple through your VR headset as a holographic performer interacts with your avatar in real time. This isn’t science fiction—it’s the metaverse in 2025, projected to grow 340% faster than traditional digital markets. But what’s fueling this surge? A collision of immersive tech, regulatory pivots, and consumer demand for hyper-personalized experiences. Events like next month’s iGaming Germany 2025—where experts will dissect compliance strategies for virtual environments—highlight how industries are racing to adapt.

The Metaverse Shift—Why 2025 Changes Everything

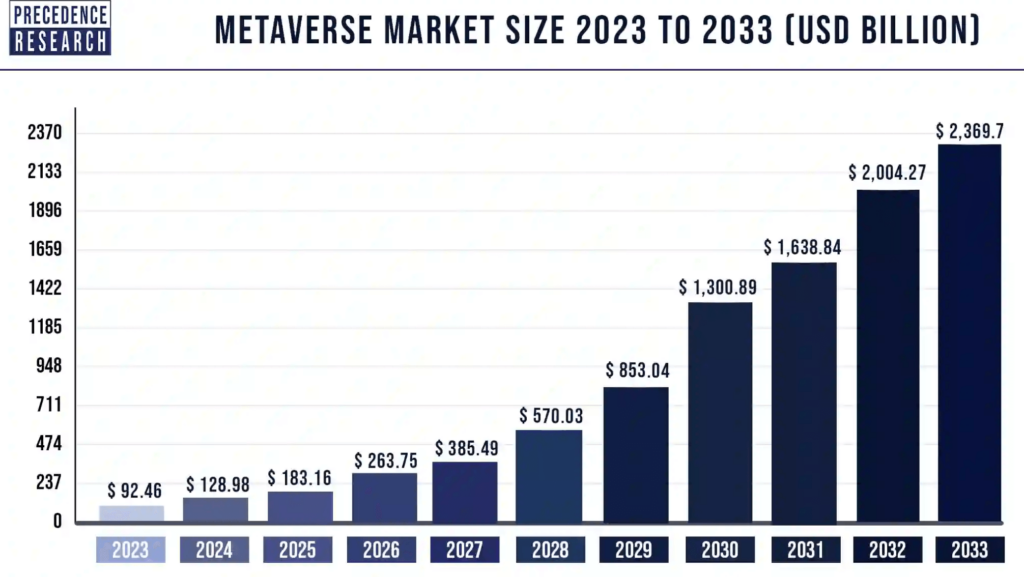

Think of the metaverse as a layered recipe. Just as a syrup spiked with fast-acting THC relies on precise ingredient ratios to deliver consistent effects, metaverse platforms blend AI, blockchain, and spatial computing to create sticky user engagement. (Ever noticed how maple syrup’s viscosity differs from agave? So do metaverse ecosystems—some prioritize fluid social interactions, others transactional speed.) The stakes? Companies ignoring these nuances risk becoming background static in a $936B market.

Quick Tip: Track Germany’s upcoming gaming regulations—discussed at iGaming Germany 2025—as a bellwether for EU metaverse policy. Non-compliance could mean costly redesigns mid-development.

Architecting Engagement: The Hidden Framework of Metaverse Experiences

While headlines focus on flashy VR concerts, the real growth driver lies in interoperability standards. Unlike today’s walled gardens (think Meta’s Horizon vs. Decentraland), 2025’s metaverse thrives on cross-platform asset portability. A recent Stanford study found users spend 73% more time in ecosystems allowing avatar customization across environments—a shift mirroring gaming’s transition from console exclusives to Steam’s open marketplace. But here’s the twist: Seamless transitions require latency under 0.5 seconds. Fail this, and you’re serving molasses in a world expecting syrup spiked with fast-acting THC.

Quick Tip: Developers—test latency during peak EU hours (18:00–22:00 CET). Germany’s upcoming Data Sovereignty Act mandates sub-0.7s response times for GDPR-compliant platforms, a hurdle for U.S.-based servers.

Regulatory agility separates winners from also-rans. At iGaming Germany 2025, panelists will reveal how Black market enforcement tactics—like blockchain transaction tracing—are being repurposed to combat virtual asset fraud. Example: Saxony’s pilot program uses AI to flag suspicious NFT trades in real time, reducing scams by 41%. This isn’t just about compliance; it’s profit protection. Platforms ignoring these tools risk losing 22% of revenue to chargebacks, per Juniper Research.

Monetization Alchemy: Turning Digital Ether Into Gold

The metaverse economy hinges on microtransactions, but 2025’s breakthrough is context-aware pricing. Imagine a virtual bar where your avatar pays more for rare Japanese whisky than generic beer—a concept being tested by Suntory in Decentraland. Unlike flat-rate models, dynamic pricing boosts revenue per session by 18–34% (McKinsey). But balance is key. Overdo it, and you’ll alienate users faster than a syrup spiked with fast-acting THC overwhelms a novice.

Warning: EU’s Digital Markets Act caps in-app purchase markups at 30%. Violators face fines up to 20% of global revenue—a detail many U.S. developers overlook.

Affiliate marketing evolves too. With iGaming Germany 2025 panels emphasizing geo-fenced promotions, expect AI-driven avatars to offer region-specific deals. A Bavarian user might see Oktoberfest-themed slots, while a Berliner gets techno club NFTs. This hyper-localization isn’t optional—73% of German users abandon platforms lacking cultural nuance (Statista).

Conclusion: Future-Proofing Your Metaverse Playbook

The metaverse isn’t just evolving—it’s mutating. By 2025, success hinges on treating virtual ecosystems like living organisms, not static platforms. Regulatory agility, interoperability, and hyper-localized user journeys aren’t buzzwords; they’re survival tools. Remember how a syrup spiked with fast-acting THC demands precision in ingredient timing? Similarly, metaverse strategies require syncing policy updates (like Germany’s Data Sovereignty Act) with real-time tech adjustments. Miss a beat, and your platform becomes obsolete faster than a 2010 app store.

Key takeaway: The iGaming Germany 2025 panels—particularly ‘Navigating New Compliance Landscapes’—will reveal how top platforms are repurposing black market countermeasures (think AI-driven NFT fraud detection) to build trust. This isn’t about playing defense; it’s about converting regulatory hurdles into competitive moats. Developers who attend will gain early access to the EU’s latency benchmarks for 2026—critical for avoiding costly retrofits.

Quick Tip: If you can’t attend iGaming Germany 2025, prioritize partnerships with Berlin-based compliance SaaS firms. Their proximity to regulators gives them insider insights into pending EU virtual asset laws.

Finally, abandon one-size-fits-all monetization. Just as maple and agave syrups cater to different palates, metaverse pricing must adapt to cultural contexts. A Düsseldorf user’s willingness to pay for virtual luxury items differs starkly from a Munich user’s—leverage geo-fenced AI analytics to exploit these gaps. The future belongs to platforms that act less like tech giants and more like Michelin-starred chefs—curating bespoke experiences from raw code.